Nations that attempt to limit cryptocurrencies’ ability to solve these problems will find that protecting high costs and systemic friction will grind their economies into dust.

There’s a great deal of confusion right now about the regulation of cryptocurrencies such as bitcoin. Many observers seem to confuse “regulation” and “banning bitcoin,” as if regulation amounts to outlawing bitcoin.

Further confusing things is the regulation of cryptocurrency exchanges, where cryptocurrencies are bought and sold.

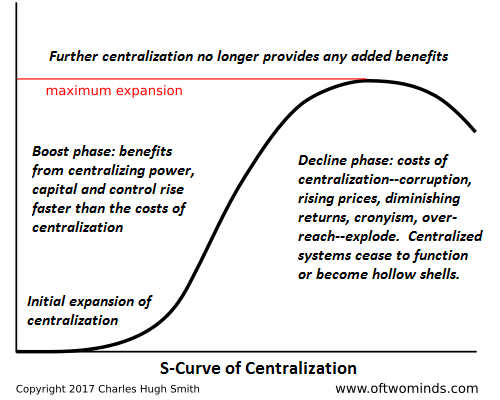

In China, for example, cryptocurrencies are not outlawed, but exchanges were shut down until regulators could get a handle on how to deal with the potential for excesses such as fraud, misrepresentation, etc.

A Wild West free-for-all is conducive to scammers, and so some thoughtful regulation that protects users is to be welcomed.

Governments tax income and capital gains. This is how they fund their activities. Clearly, gains reaped from cryptocurrencies are no different from gains reaped from other speculations and investments, so they should be recorded and taxed in the same manner.

Some enthusiasts of cryptocurrencies seem to think that regulations requiring the reporting and taxation of gains made buying and selling cryptocurrencies is tantamount to destroying cryptocurrencies.

I think this view has it backwards: fully legalizing and regulating cryptocurrencies as financial instruments legitimizes them in a much wider circle of potential users, and common-sense regulations are to be encouraged and welcomed, not viewed as threats to cryptocurrencies.

I want to stress that beneath all the speculative frenzy we see in the cryptocurrencies, what will retain value and remain scarce and in demand is whatever solves problems.

Cryptocurrencies have the potential to solve two problems:

- reducing the cost and friction of financial intermediaries.

- holding value as the $250 trillion in phantom wealth created in the asset bubbles of the past 12 years vanishes.

These are real problems: financial intermediaries introduce a great amount of friction and cost globally, and even a modest reduction in cost and friction (time, effort, compliance, recording transactions, etc.) would add up very quickly.

The global value of real estate, stocks, bonds and debt-assets such as mortgages and auto loans is around $500 trillion. By my rough estimate, about half of this was created in the past 12 years as central banks inflated enormous bubbles.

A house that was worth $200,000 in 2005 is now worth $500,000, but it provides no additional value as shelter; it is the exact same house with the exact same utility value. So the additional $300,000 of current market value is entirely phantom wealth.

The same can be said of all the other assets whose value has skyrocketed: the underlying assets/collateral haven’t changed enough to justify the current valuations.

Once the bubbles in stocks, bonds, housing, commercial real estate and debt-assets start popping, the owners of all that phantom wealth will be desperate to sell what is dropping in value and convert that wealth into assets that are either holding their value or appreciating.

Virtually all of this newly created financial “wealth” is ephemeral. Bitcoin et al. are routinely criticized as being “worthless” due to their digital/ephemeral nature.

But critics rarely if ever examine the equally ephemeral nature of $250 trillion in financial “wealth.”

Bitcoin in particular has two features which may be viewed as having value as all these coordinated bubbles pop:

- The organization and distribution of bitcoin is mathematical. It is not something that can be changed at the whim of a handful of self-serving people in a room (i.e. central bankers).

- It is limited in quantity.

Some critics claim this can be changed, but that’s not the way it works. A group of bitcoin miners can propose a new version of bitcoin that will issue a trillion coins, but if nobody supports their new version, it dies.

In other words, the marketplace of users decides what has value and what doesn’t.

Regulations that enable cryptocurrencies to solve the two problems listed above should be welcomed, as these problems are structural and impact everyone in some fashion.

Nations that attempt to limit cryptocurrencies’ ability to solve these problems will find that protecting high costs and systemic friction will grind their economies into dust.

I’m offering my new book Money and Work Unchained at a 10% discount ($8.95 for the Kindle ebook and $18 for the print edition) through December, after which the price goes up to retail ($9.95 and $20).

I’m offering my new book Money and Work Unchained at a 10% discount ($8.95 for the Kindle ebook and $18 for the print edition) through December, after which the price goes up to retail ($9.95 and $20).

Read the first section for free in PDF format.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.