By Joe Jarvis

By Joe Jarvis

The power or right to act, speak, or think as one wants without hindrance or restraint… that’s freedom.

For many, the word means the ability to do as they see fit. For some, it’s a call to action. And for others, freedom is a dream worthy of giving their lives.

Fortunately for a good number of people within the Western world, freedom is something we have come to expect within our daily lives.

Though for as often as we hear and speak of our freedom, there still exist many areas in which freedom is merely just a word.

And in no area is that lack of freedom felt more heavily than within banking institutions. We rely on these institutions and companies for critical aspects of our lives. Yet all too often they serve only themselves at to the detriment of their customers.

Modern Banking and the Bonds of Finances

The advent of modern banking grew out of a principle of providing people with a utility. Banks could be relied upon and used to advance customers’ living standards and financial security.

Though as populations boomed and business continued to soar, banking shifted into a $100 trillion dollar industry globally.

With that shift came a change in the way that banks conducted themselves.

Loans took on a predatory nature with the help of government incentives. They no longer were designed to help individuals attain the things they could use to better their lives. But instead, loans trapped individuals into a spiraling debt cycle to drive banking profits higher.

Fraud became more widespread and much more difficult to prosecute. Often perpetrators simply resigned with a healthy severance package earned from their misdeeds.

And regulators became embroiled with those they were meant to be regulating. Lobbying on behalf of commercial banks became a standard practice.

The entire industry shifted into becoming a source of distrust and malalignment among average citizens. And after the 2008 financial crisis and the subsequent bailouts, that distrust only grew.

In the aftermath of the 2008 financial crisis, the uglier side of the banking industry became quite apparent.

The truth about the predatory loans and the shady dealings of corporate banks started to come to light over time. Stories of how major banks had acted against the interest of the people they served began to become the norm.

Though ugly as it is, modern banking and its major players have not changed at all nor lost their grip on power over countries. If anything they’ve strengthened those bonds.

Those bonds have formed a deep connection with the way we live.

Without banks, many of the things we take for granted, things as simple as buying a morning coffee, would be much more difficult.

On top of that, modern life almost necessitates the need for an individual to do business with a bank.

Understandably, the inability to live without banks is a limitation of personal freedom in the true definition of the word. But how can that be changed?

Cryptocurrencies and a New Type of Finance

By now, most people are familiar with cryptocurrencies in some fashion. Whether or not they fully understand them, though, is based upon their exposure. But with the popularity of Bitcoin in the news, most are at least aware that a different currency exists outside of the typical one.

It was Bitcoin that brought cryptocurrency into the spotlight, introducing many people to the idea of a financial system operating outside of the reach of major banks. Though, unfortunately, it was also Bitcoin that rather soured the average citizen on the idea of cryptocurrency as well.

Its–relatively–anonymous exchange coupled with media efforts to link cryptocurrency with crime, sullied the first impression people had with the currency. There was also misconduct of certain individuals within the Bitcoin sphere, which led to cryptocurrency being mislabeled and misunderstood.

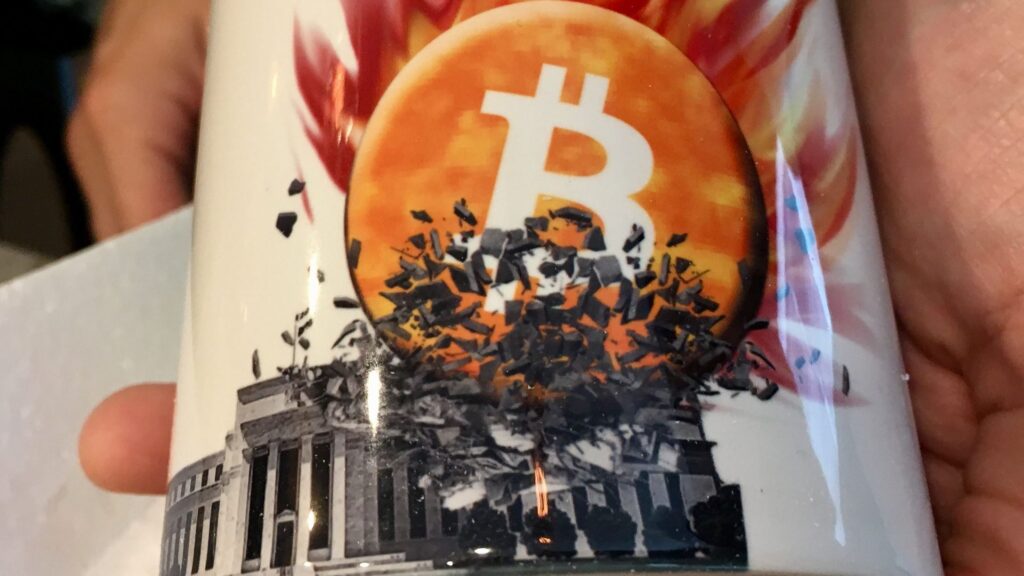

But what if we take a step back to look at the cryptocurrency for what it is and what it can do? We see the best possibility for breaking the chains of modern banking and freeing people from the power of the banks.

Cryptocurrencies are a way to remove major banks from the equation of personal finances.

They allow people to trade, buy, sell, and use a medium of exchange more quickly, more securely, and without the need for a bank.

In principle, cryptocurrencies are the best way for people to take back their freedom to act in their own best interests, without relying on manipulative banks.

The Blockchain and Secure Banking

The sense of security that you can get from a major bank stems from the ability of the bank to process and reflect transactions in an accurate way.

Banks act as the intermediary ensuring all transactions are to some level accurate and secure from fraud.

But for the sense of security it gives individuals, modern banking is anything but secure.

Fraud occurs from within the institution itself, as witnessed by the major scandal facing Wells Fargo.

From the outside, banks are not impervious to breach as hackers often break into the networks used by banks.

So, that sense of security is merely a feeling and not reflective of the reality of modern banks.

Banking can be done securely. But the current system is unable to do it.

This is where cryptocurrencies flourish.

The technology behind cryptocurrencies relies on a principle called the blockchain.

The simplest explanation is that the blockchain is a means of securing information across a vast network of computers. By design, it ensures that transactions are always conducted in a secure fashion. Anyone can confirm this on the public ledger.

The science behind the blockchain requires an understanding of cryptography and the ways in which computers communicate. In application, it is simply a built-in system that protects the accounts of every person within the system.

And yes, hackers can steal tokens kept in online wallets. But there are hardware wallets, kept offline, that are like safes for different cryptocurrency, and even allow recovery if stolen. Yet they are thus far impervious to hackers.

Slovenia’s Push to Modernize Banking: Blockchain on a National Scale

And while most of the world grapples with the idea of cryptocurrencies, one country has stepped forward to embrace the blockchain and the type of banking it promotes.

Slovenia has been a haven for innovation over the years embracing changing technology. Entrepreneurs and tech-based startups are continuously relocating to the country.

This is due to the forward thinking that has now begun to define the country.

So it should come as no surprise that it would be the first nation to openly embrace the blockchain.

The announcement that Slovenia would begin looking into applying blockchain based banking came directly from a statement made by Prime Minister Miro Cerar.

While addressing a crowd at the 2017 Digital Slovenia 2020 convention, Prime Minister Cerar announced that he wished to position Slovenia as the leader of blockchain innovation within the EU. He further went on to say Slovenia would look towards developing a national application of the technology.

Doing so would not only legitimize blockchain throughout the world but also set the precedent for finally breaking free of the modern banking system.

The application of the blockchain and its use within a national system is still in developmental stages within Slovenia. But already this signals to other nations that they will have to compete or risk losing advanced business and entrepreneurs to neighboring states.

So, proponents of the system across the world look towards the future success of Slovenia with eager anticipation.

Its success could open the doors for a wider utilization and could very well signal the end of the modern banking industry.

And with it, the end of the stranglehold commercial banks have over citizens.

Joining the Modern World and Freeing Yourself

The world can look towards Slovenia to prove that the blockchain will serve a greater purpose on a national level.

But individuals can already free themselves from the modern banking system.

You too can join the movement towards a decentralized banking system by diversifying your savings to spread risk beyond commercial banks. Holding an amount of cryptocurrencies that you could still afford to lose would be a good start.

There are already systems in place to make the utilization of cryptocurrencies as easy as the current system. In fact, a number of businesses now accept Bitcoin and more are joining their ranks with each day.

It may be prudent to maintain an account with a commercial bank for the time being. But moving more assets towards cryptocurrencies strengthens the currency itself and increases demand on businesses to adapt to the new currencies.

By participating, we help to lay the foundation for the largest overhaul of the banking sector in generations. This moves society towards a more free and independent future. One without the bonds of modern banking.

You can read more from Joe Jarvis at The Daily Bell, where this article first appeared.