By Jeff Paul

Is Bitcoin still waiting for a “killer app” to take it mainstream?

As if permissionless international programmable money wasn’t enough of an amazing achievement, people are demanding more from Bitcoin.

A killer app may be defined as single application that spurs mass adoption due to its overwhelming usefulness. Since Bitcoin is still widely a mystery to the general public, many think its killer app hasn’t been discovered.

Yet several developments have more than proven Bitcoin’s usefulness and, thus, the reason for its climbing value.

You may think Bitcoin’s rising price is a bubble, but as you will see below, Bitcoin’s adoption is growing fast as existing applications are getting much easier to use. This increase in ease of use alone may indeed be enough to carry it into the mainstream and send the price much, much higher.

Bitcoin’s Core Application

Forget fancy new sidechain applications for a moment and let’s get to the root app. Bitcoin is an open digital currency built into a payment system. Anyone in the world can use it with a smartphone to accept international payments and spend or invest those proceeds internationally, without a middleman or without fear of fraud and ID theft.

Yet, until somewhat recently, it’s been complicated for the average person to use. In the early days it was difficult to 1) find an easy-to-use wallet that was compatible with your favorite device, and 2) find a way to get your first Bitcoins.

Both of these barriers have been conquered. Now, you can buy Bitcoin with a debit card and download an app to exchange them for any currency in the world on your PC, iPhone or Android. And since its algorithm is fixed to only produce 21 million Bitcoins, they’re a scarce commodity similar to gold. Therefore, holding Bitcoins as an investment has been the most common application to date.

That’s great, you say, but I’m not a Forex day trader, so who cares? What does Bitcoin do besides exchange money?

Early Applications

Because the Internet and Bitcoin are borderless, and nations have differing laws, cryptocurrency created a new paradigm of permissionless commerce. Thus Bitcoin first proved its usefulness as the currency for black and gray markets for drugs, casinos, porn and activists. Admittedly, this period was not good for Bitcoin’s public relations.

However, Ashton Kutcher, actor and an early VC investor in Bitcoin start-ups, said at TechCrunch Disrupt NY in 2013 that its use in dark markets validated the cryptocurrency to him. “It actually validates the value of the money itself,” he said. “I think the fact that you can buy drugs and ammo with it is actually (a) validator of the currency itself.”

Darknet Markets

The world’s first anonymous marketplace, Silk Road, appeared in 2011. This website ingeniously combined the technologies of Tor, Bitcoin, encryption and market reputation systems to be an “eBay for drugs.” Its success increased the demand for Bitcoin tremendously. The liberty-motivated developer of Silk Road, Ross Ulbricht, is currently appealing a double-life sentence for nonviolent charges.

Online Gambling

Another early use case was online gambling. Erik Voorhees, current CEO of permissionless digital currency exchange ShapeShift.io, proved Bitcoin’s resiliency for casinos when his Satoshi Dice website did over $15 million in Bitcoin bets in less than a year in 2012.

In the past, as an American even with a VPN (virtual private network to hide your IP address), you couldn’t fund gambling accounts. Bitcoin changed all of that, even though new online bitcoin casino websites mostly abide by local regulations (if you don’t have a VPN).

Even with regulations, Bitcoin provides superior efficiency and immediate payouts for online casinos. I think Bitcoin or something like it will underpin settlements for most digital gambling before too long.

Porn Privacy

Viewing porn is taboo. People don’t want their sexual viewing habits showing up on their Visa bill or anywhere else. Nor do they want to give the porn websites their private details like their real name, mailing addresses, etc. Remember PayPal was invented to solve this exact problem? Yet high fees and privacy issues still persist. Enter Bitcoin which allows customers to pay for porn more anonymously, while also empowering models with lower fees and expanded access.

Funding Activists

Many activists first discovered Bitcoin in fall of 2012 when WikiLeaks was blocked from accepting donations by regulated payment processors for releasing leaked government documents and videos. WikiLeaks quickly raised $32,000 in Bitcoin when they were only $10 each.

Shortly after that, payment processors cut service to Cody Wilson’s 3D-printable gun design firm Defense Distributed. They turned to Bitcoin, and Wilson immediately recognized its power to be censorship proof. Wilson went on to spearhead an anonymous wallet project called the Dark Wallet. With these two cases, the world learned that funding for dissidents can no longer be stopped by governments.

Potential Killer Apps

At this point you may have the impression that Bitcoin is only being used by the naughty fringe due to being borderless, anonymous and permissionless. Bitcoin has even more benefits that appeal to both main street businesses and Wall Street such as its fraud-proof autonomous record keeping, super low transaction fees and the ability to program payments.

The Blockchain (Autonomous Fraud-Proof Ledger)

The open ledger that records all Bitcoin transactions is called the blockchain. It’s a powerful accounting invention on its own. Significantly, blockchain ledgers update autonomously and are counterfeit proof. In fact, major credit card companies are investing in blockchain technology to use for internal bitcoin accounting and cross-border payments.

However, private blockchain networks – as opposed to the open Bitcoin network – are closed to outside development and have limited security. Blockchains are secured with computing power. And since Bitcoin is the most secure computer network in the world, it will likely have the most apps built on it … though it is getting competition from other blockchain platforms like Ethereum.

The killer uses for blockchains seem to be:

1. Crowd Equity Funding & Stock Market Trading

Before recently taking time off for health reasons, Overstock CEO Patrick Byrne committed to creating a fraud-proof stock market using blockchain technology. Several companies are now working on similar projects.

Meanwhile, permissionless crowd equity funding is already happening in a big way. This past May, a distributed autonomous organization called The DAO raised over $150 million in a crowd sale of their Ethereum-hosted token, making it the largest crowd equity sale in history. The tokens represent equity ownership and voting rights for the company which will serve as a hub for blockchain development.

Even though The DAO was hacked and exploited, it’s funding success means others companies will explore this funding model.

2. Real Property Registries

Any information that requires a public registry to record ownership or transfers of ownership with time stamps could be replaced with a much more efficient blockchain. Look for states or small municipalities to begin implementing blockchain solutions to real estate and vehicle registries in the very near future.

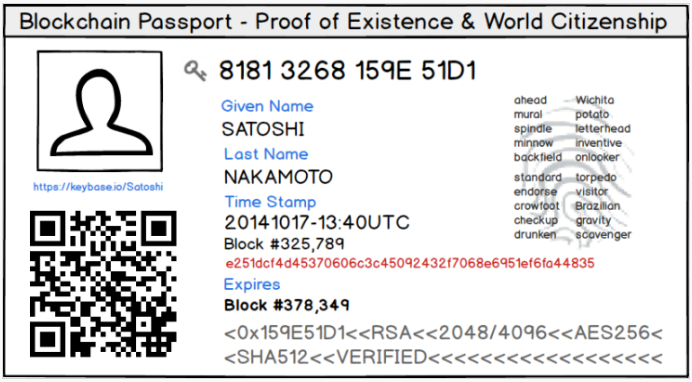

3. Identity and Reputation Systems

One of the most brilliant aspects of Bitcoin is that it is trustless. In other words, I don’t need to know who you are to send you money and vice versa. It’s trusted like cash is trusted, while at the same time your address’s activity or “reputation” is forever recorded into the blockchain.

This feature has potential for counterfeit-proof identification and reputation verification. Several projects are attempting to capitalize on this application.

A report by Long Finance explains “the immutability of transactions and records on the blockchain reduces the opportunity to defraud while increasing the consequences of being caught, thus the chain is a ‘lifetime’ and as one participant said, ‘rewards the good, punishes the bad’.”

Voting

Blockchains can be used to facilitate fraud-proof elections. And it’s so cheap and scalable that people in democracies could conceivably vote on everything.

Low-Fee Transactions

Mega-retailer Walmart just announced that it will no longer accept Visa payments in Canada due to high fees. If transaction fees are that big of a deal for Walmart, you better believe they’re a big deal for Mom-and-Pops around the world.

Payment services like Coinbase and BitPay are helping merchants to process Bitcoin payments and even deposit them as dollars, if desired, and for much lower fees than traditional credit card processors. Other third-party payment processors like Square are also integrating Bitcoin payments. And ecommerce platform giant Shopify allows its merchants to accept Bitcoin as payments.

Furthermore, Bitcoin is significantly more secure than credit cards. Massive credit card hacks at stores like Target and Home Depot have cost them tens-of-millions each. That’s because credit cards are inherently unsafe. They contain the key for anyone to pull money from the attached account. Whereas Bitcoin is a push mechanism, where the customer pushes the funds to the merchant’s address without exposing the private key to a bank account, or even your name for that matter. Like handing them cash.

How much longer will huge retailers continue to pay higher transaction fees for a riskier payment processor when a cheaper, safer alternative already exists?

When (not if) these retailers like Walmart, Target and Amazon integrate Bitcoin, you can probably call that mass adoption even if average people aren’t using it yet.

Programmable Payments

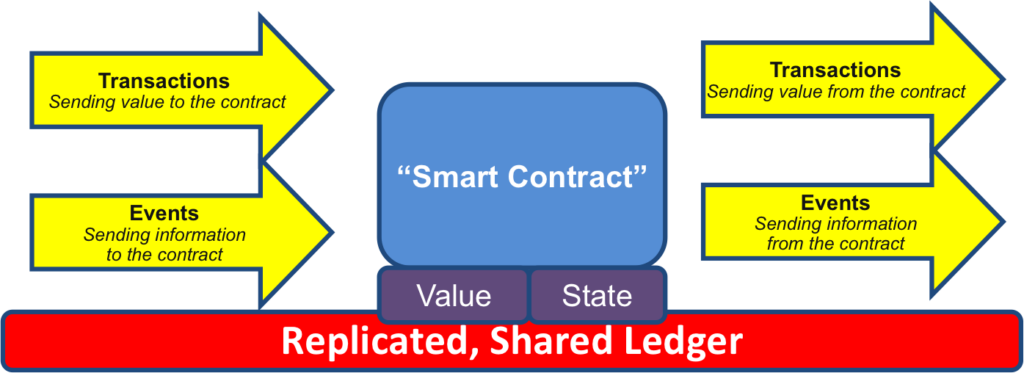

Programmable payments are swiftly becoming reality using smart contracts. Smart contracts are computer protocols that facilitate, verify, or enforce a contract.

Vitalik Buterin, a founder of Ethereum, explains “Smart contracts solve the problem of intermediary trust between parties to an agreement, whether that is between people transferring assets like gold, or executing decisions between two parties in a betting contract.”

Basically, they are simple if-then contracts — when a certain event occurs, a predetermined payment is made between parties. Typical contracts that are currently used are for escrow or other transactions that are made safer with third-party signatures.

It’s easy to picture other settlement use cases that could be automated with smart contracts, but here are a couple that I think are interesting:

Microloans and Micropayments

Several early movers recognized the potential to use Bitcoin to make loans and micropayments. BTCJam and others built platforms to connect lenders with borrowers using Bitcoin. Soon this entire business model will be built into an app with a few lines of code. Imagine being able to lend $100 from your smartphone wallet to a bunch of vetted borrowers whose monthly payments are programmed to be automatically dispersed to you and another 99 investors. If that sounds familiar, it’s generally how your bank savings account used to work when they paid interest.

President Obama recently said that strong encryption like Bitcoin means “everybody is walking around with a Swiss Bank account in their pocket.” He doesn’t know how right he is.

Insurance

Pooling money to leverage risk and to be automatically paid out when certain events occur seems to be a match made in heaven for insurance. Indeed, some insurance giants are already exploring how to use blockchain technology for their businesses. Internal blockchains may make them marginally more efficient, but the Bitcoin blockchain with smart contracts makes big bloated insurance companies completely obsolete. The fiduciary trust they currently provide is made unnecessary by a fixed algorithm.

Crowdfunded P2P insurance platforms are coming and they could change everything as explained by Olivier Rikken in an article titled “Why Blockchain Could Enable a True P2P Insurance Model” where he writes:

In the new business model, the focus of the insurers would shift away from asset management and instead would focus on matching supply and demand and to risk calculation research. The insurer would provide a marketplace-like platform where customers can post their insurance demand, which could be either a standardized product or even a specific demand.

The insurer then would use its “risk intelligence” and risk models, based on their historical data, to perform a premium calculation to post the expected return, after subtracting their margin off course.

Decentralize All The Things

The key benefit to decentralization is that there is no single point of failure, making things harder to censor, falsify or shut down. Currently there are many exciting projects aimed at decentralizing services that have been targeted for censorship or fraud.

Some remarkable decentralized projects include:

Prediction Markets

The Forecast Foundation introduced Augur, the world’s first open source decentralized prediction market, in 2015. In August they successfully raised $1.4 million in a crowdsale of Augur tokens and is in active beta.

Marketplace for Goods

OpenBazaar is an open source decentralized network for peer-to-peer commerce—using Bitcoin—that has no fees and no restrictions. They just released their beta app in April and over 16,000 merchants have already set up shop.

Library

Alexandria is an open source decentralized library project being developed by BlockTech that will allow users to publish, host and distribute digital content through peer-to-peer nodes. Think censorship-free file sharing with the potential for micropayments to original content producers.

Still, you say, what will average people use Bitcoin for? The answer will soon be: whatever you want.

Jeff Paul writes on Coinivore.com because his wife is sick and tired of hearing about Bitcoin. Follow at Twitter. Like on Facebook.