By Vin Armani

Centralization is bad.

Decentralization is good.

For years, this has been the mantra of the Bitcoin community. “Decentralized” is to adherents of the Bitcoin faith what “kosher” is to adherents of Judaism or “halal” is to the Muslim faithful. The roots of (and reasons for) this devotion are, in all cases, rarely examined by adherents. As the crypto space expands with a greater population of individuals with little to no engineering background, the value of “decentralization,” in all things cryptocurrency-related, is taken for granted. In fact, I frequently encounter community members who believe that “decentralizing all the things” is the path to peace. Considering that lynch mobs are decentralized organizations (that is in fact what the word “mob” indicates), such a desire for absolute decentralization is foolish at best, suicidal at worst.

Are you triggered yet?

If your answer is “yes,” then this article is for you. In it, I am going to do a brief exploration of what “decentralization” actually means in the context of Bitcoin, as well as exploring why decentralization is, indeed, good in some important contexts. I also want to shed light on why, given the problem Bitcoin is attempting to solve, centralization in some spheres of the Bitcoin ecosystem is actually a very good thing.

Bitcoin was designed to solve a very specific problem. Decentralization is not a means to solving that problem. Decentralization is the end goal.

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model.

Completely non-reversible transactions are not really possible, since financial institutions cannot

avoid mediating disputes…What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers.

–Satoshi Nakamoto, The Bitcoin White Paper (Introduction)

Satoshi created Bitcoin because, in looking at the landscape for digital payment networks, he saw a fundamental problem: the authorities in control of the financial networks had the ability to censor financial transactions between a willing buyer and a willing seller. This authority to reverse or block payments is centralized. Most of the time, when this authority is used, it is relatively benign, such as reversing fraudulent purchases made by identity thieves.

However, the mere fact that such a power exists presents a fundamental issue. The relationship between governments and banks is such that these parties have assumed for themselves the right to intercept financial transactions or even to exclude certain individuals from the networks altogether. Satoshi realized that any system that relied on a central authority to determine what transactions were and were not valid would inevitably end up being used as a tool of such censorship. Those who have the desire to censor and who reap great benefit from the use of such censorship (read: governments), have every incentive to take control of such networks (The EU’s threat to exclude Russian banks from the SWIFT network is a major, recent example). Bitcoin is Satoshi’s answer to this problem.

Instead of relying on a central authority to be the final arbiter of whether or not a transaction is valid, Bitcoin uses a consensus model which relies on cryptographic proof and Proof-of-Work. Satoshi said of this design, “The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes.” Authority is dispersed throughout the network. In order to gain the ability to reliably censor transactions, an authoritarian would have to gain control of a majority of the nodes (actually hash power) in the network. Such an attacker, however, could not prevent new nodes from joining the network to thwart his attempt. Further, so long as the software code used to run nodes is released as open source, the authoritarian can’t prevent software forks that create entirely new networks. To completely control Bitcoin, a party would have to control a majority of hash power on every single network. Any existing network where “honest nodes collectively control more CPU power” is censorship resistant.

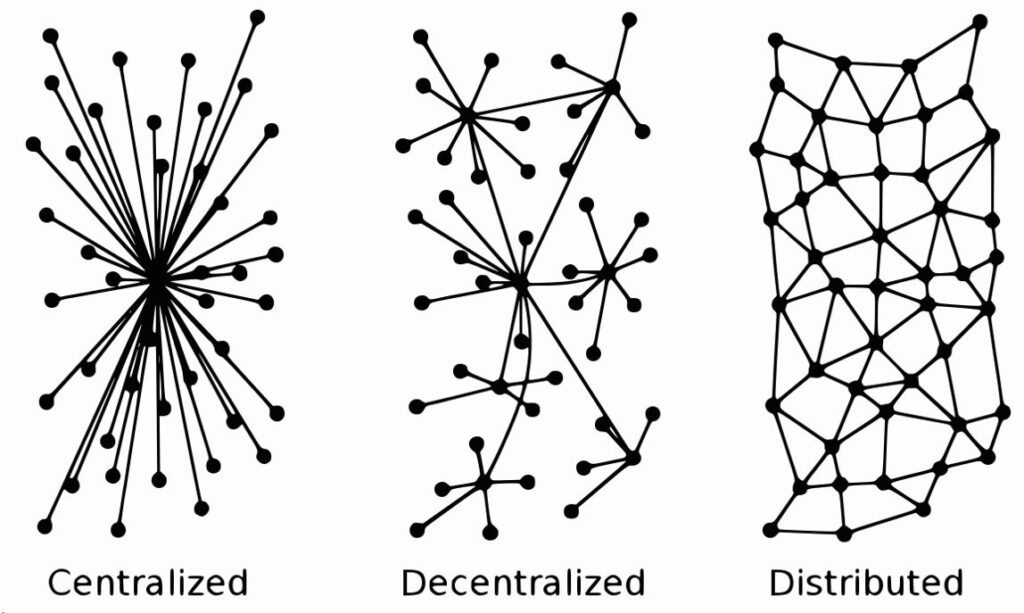

One of the biggest misconceptions about decentralization in Bitcoin is that the term “decentralization” necessarily refers to the topology of the network itself. If you’ve been in Bitcoin for long enough, you’ve no doubt seen the diagram from Paul Baran depicting centralized, decentralized, and distributed networks.

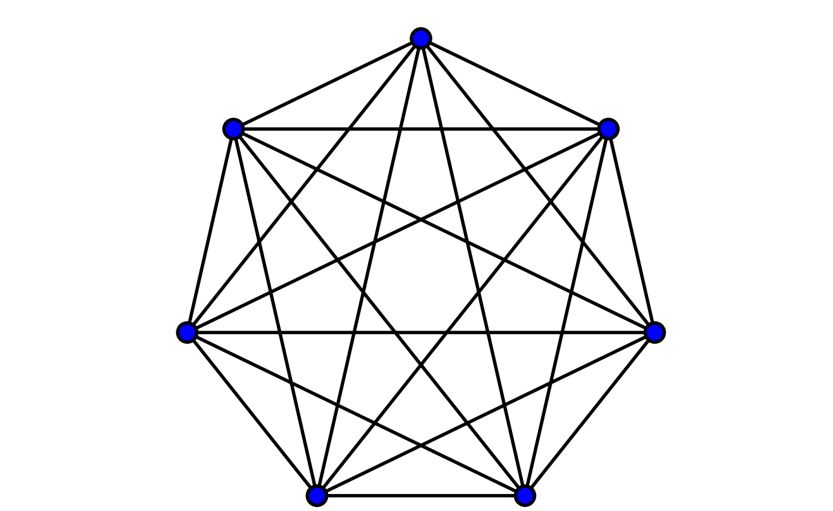

If you’ve been in Bitcoin even longer, particularly if you’ve paid any attention to Craig Wright, you’ve probably seen him argue that the topology of Bitcoin (at least between mining nodes) is closer to the complete graph diagram below.

Satoshi tells us, however, that the security of Bitcoin – whether or not transactions can be censored at will by some authority – is determined not by the topology of the network but by the percentage of individual nodes controlled by a would-be censor.

The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes.

— Satoshi Nakamoto, The Bitcoin White Paper (Introduction)

From the standpoint of Satoshi, a network with a centralized topology where the single centralized node is controlled by an “honest” actor (one who refused to censor) is actually more secure than a Bitcoin network – a decentralized topology – where a majority of CPU power is controlled by a censorship-happy authoritarian. Simply having a decentralized topology does not solve the fundamental problem that Satoshi addressed with Bitcoin.

Satoshi is very clear on the fact that a network with a decentralized topology can absolutely still be centralized in terms of authority – the centralization that actually matters in the context of Bitcoin. There is no doubt that a decentralized network topology should tend to be more censorship resistant than a centralized network, but it is certainly no guarantee. The decentralization Bitcoin is after is the removal of a central authority, a censor.

While decentralization, the lack of a central authority, is clearly advantageous on the base layer of Bitcoin – the blockchain and mining node network – the particular incentive structure of Bitcoin makes some degree of centralization preferable at the application layers built on top of the base layer.

The incentive [system] may help encourage nodes to stay honest. If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back his payments, or using it to generate new coins. He ought to find it more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth.

— Satoshi Nakamoto, The Bitcoin White Paper (Incentives)

It is the incentive system, not the network topology, that keeps those who may end up gaining a majority of hash power from censoring transactions. To put it simply: for someone in control of a majority of hash power, it is more profitable not to censor transactions than it is to censor transactions.

This is a powerful property of Bitcoin and it is primarily this property that delivers Bitcoin’s security. Even if an “attacker” (Satoshi’s term) was to gain majority hashpower on a Bitcoin network and begin censoring transactions, he would be quickly put out of business by a competitor who simply forked the network, took majority hash power of the new network, and behaved in an honest manner. It is worth noting that even in the recent Hash War which took place on the Bitcoin Cash network, not a single transaction was reported to have been lost or censored by either of the belligerents.

This “incentivized honesty” is magnified at Bitcoin’s application layer, where entrepreneurs are competing in a permissionless environment, at least as far as access to the payment network is concerned. A wallet or an exchange that censored transactions or seized funds in transit, something governments and banks do every minute, would quickly see its users move to a competitor who had not participated in such behavior.

I will speak in a future article about the importance of profit-seeking in Bitcoin, but suffice it to say that, at the application level, the service being provided by any business is assumption of risk on behalf of their users.

Assumption of risk is, necessarily, centralization of risk: “with great power comes great responsibility.” While participants in the Base Bitcoin layer are incentivized to keep their infrastructure as open as possible, at the application layer, walled gardens with limited access (as with exchanges) are absolutely necessary to mitigate risk to users of the platform. If platforms cannot take on and mitigate risk (the service for which users are paying), those platforms cannot turn a profit. In this way, there are parts of the Bitcoin ecosystem – within individual enterprises – where centralization is preferable. However, because the base layer of Bitcoin has no central authority who can prevent participation (it is “permissionless”), interaction with any business or project at the application layer is a completely voluntary act by a user.

Bitcoin is a brilliant tool for a very specific task: allowing a willing buyer and a willing seller to exchange value without the imposition or censorship of a central authority. The “decentralization” that is valuable in Bitcoin, the removal of a central authority, is valuable precisely because it represents censorship resistance. It is not fundamentally a decentralized network topology that keeps Bitcoin free from “attack” (censorship), it is the incentive structure implemented by Satoshi Nakamoto. If we are aware of the true purpose of decentralization, then we realize that what we are truly after is nothing less than the absence of censorship, and the flowering of voluntary economic activity in a free market.

When we take back our individual financial sovereignty, through participation in Bitcoin, we centralize authority of our individual economic reality in our own hands… right where it belongs.

Vin Armani is the founder and CTO of CoinText, co-founder of Counter Markets, instructor for CodeFromGo beginner’s coding course, and the author of Self Ownership. Follow Vin on Twitter.