The Financial Stability Board, G20’s global watchdog, doesn’t consider cryptocurrencies a risk to financial stability or see a reason for regulation.

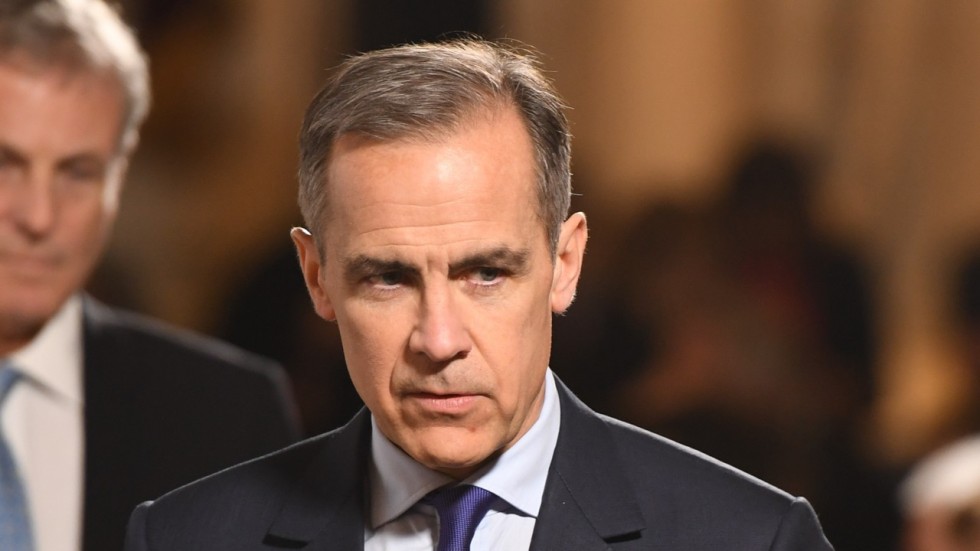

In a letter to the Group of 20 central bankers and finance ministers, FSB Chair Mark Carney said his agency was pivoting away from designing new policies and focusing on reviewing existing laws. His comments suggest there is no G20 consensus on common crypto regulations, despite calls from member-states for adopting global rules for cryptocurrency.

The Financial Stability Board (FSB), the body that coordinates financial regulation for the G20 countries, has effectively dismissed calls from member-states to adopt global cryptocurrency rules. “The FSB’s initial assessment is that crypto-assets do not pose risks to global financial stability at this time,” its Chair Mark Carney said in a letter to central bankers and finance ministers, Reuters reported.

Representatives from G20 countries are meeting today in Argentina to hold two separate discussions on cryptocurrencies.

Although the agenda and talking points for the two discussions have not been publicly released, a public document indicates that world leaders’ discussions will revolve around the implications of cryptocurrencies and the potential applications of its underlying technology.

The G20 includes central bankers and leaders from 19 countries and the European Union, spanning the entire globe: Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, Turkey, United Kingdom, and the United States.

Carney’s comments suggest, however, that there is not enough consensus for a “common approach” to cryptocurrency regulation. The Financial Stability Board insists on more international coordination in monitoring the rapidly evolving crypto sector with existing laws instead.

“As its work to fix the fault lines that caused the financial crisis draws to a close, the FSB is increasingly pivoting away from design of new policy initiatives towards dynamic implementation and rigorous evaluation of the effects of the agreed G20 reforms,” Carney said.

“The time has come to hold the crypto-asset ecosystem to the same standards as the rest of the financial system,” Carney stated in a speech earlier this month, CNBC reported. Carney further described the volatility associated with crypto markets as “speculative mania”. Commenting on the possibility of adopting global crypto rules, he admitted the regulation would likely be on a country-by-country basis.

“I would have a greater expectation for a series of national steps rather than some big coordinated approach,” the central banker said. He also voiced support for the idea to regulate some elements of the crypto-asset ecosystem to “protect the safety and soundness of the financial system”.

However, Carney stated that if cryptocurrencies became larger they could threaten the stability of the economic system:

“Wider use and greater interconnectedness could, if it occurred without material improvements in conduct, market integrity and cyber resilience, pose financial stability risks through confidence effects,” Carney wrote.

The G20 summit will take place in the Argentine capital Buenos Aires on March 19th-20th.

Bitcoin is currently trading at [FIAT: $8,337.10] up 8.03% according to Coin Market Cap at the time of this report.

Want an edge in the crypto markets? Subscribe to our free newsletter. Follow Coinivore on Facebook, at Twitter and Steemit.