According to a recent report, Google has recently achieved quantum supremacy by creating a quantum computer that is able to solve previously impossible mathematical problems and calculations.

Why does that matter?

It matters because, if taken to its logical conclusion, the rollout of quantum computing at a sustainable commercial scale could destroy two other fast-growing areas of the technology economy; blockchain and cryptoassets. Astutely noted by Jeffrey Tucker here, both the proof of work (PoW) consensus methodology, and the public key/private key encryption that create the value of the bitcoin blockchain, could potentially be undermined by the rise of quantum computers.

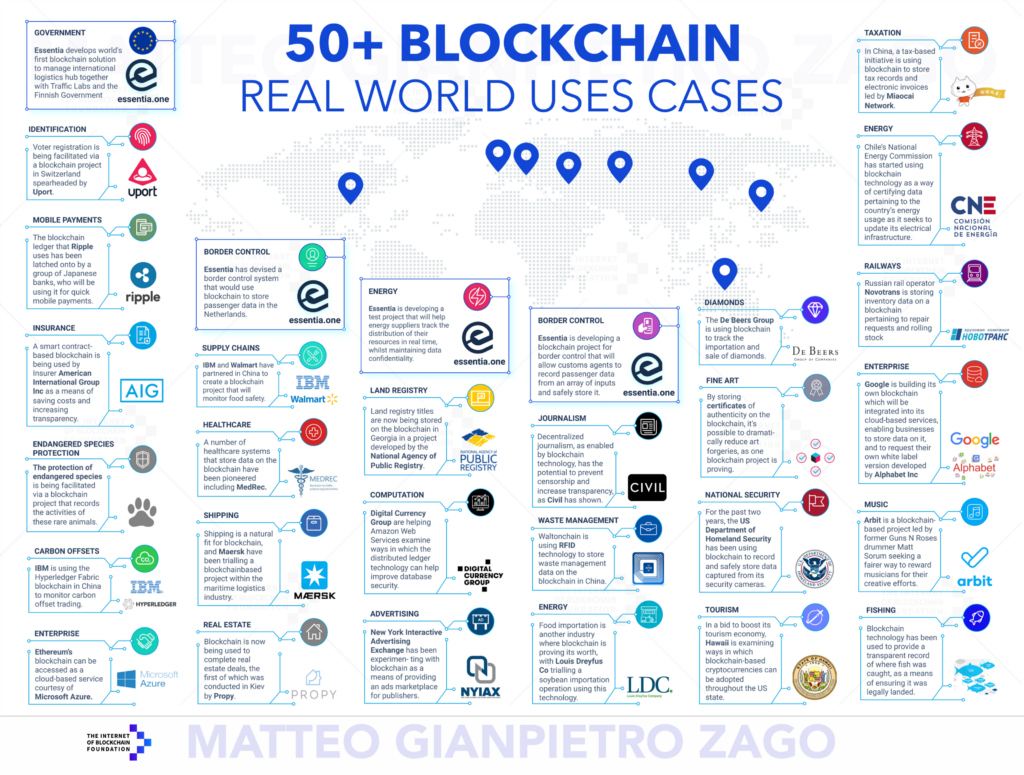

Since Bitcoin burst into the headlines with its meteoric rise and then collapse in price beginning in 2016, the blockchain economy has been growing at breakneck speed. Far from the obscure beginnings of the bitcoin blockchain, some of the largest and most successful organizations in the world have pumped billions of dollars and tens of thousands of employee hours to develop and scale blockchain or crypto solutions.

Quantum computing could potentially render all of these investments and even entire organizations obsolete. Breaking the cryptography — which at the end of the day is security or encryption enabled by mathematics — undermines the entire value proposition of blockchain projects. Without this encryption and the consequent trust that this encryption delivers there isn’t much of a point in continuing to develop blockchain applications. In addition to the financial market implications of this, the other use cases such as improving food traceability and safety, creating a more tamper-resistant voting system, returning digital identity control to individuals, and building a financial system removed from the whims of political and technocratic leaders would be all but swept away.

Instead, the governments or companies that win the quantum race would centralize control over data and the economic benefits associated with this information.

The reality, however, is more nuanced than announcing a quantum computing fait accompli.

Quantum computing is not a new idea; indeed, both the mathematics and experimental quantum computers have existed for years. The difference now, according to the report, is that organizations (including firms like Google) are rapidly approaching the ability to create commercially viable quantum computing. Even with these advances, however, there has not yet been a quantum computer able to operate for substantive lengths of time at a commercial scale. The rapid acceleration of quantum development does, despite this, pose an existential threat to the blockchain ecosystem: timelines are continuously being revised to reflect the rapid pace of quantum development. That said, most estimates put the timeline for quantum to realistically threaten the integrity of the bitcoin blockchain approximately 10 years in the future.

Blockchain specialists, and the organizations developing and building out blockchain applications, are not defenseless against this threat.

The blockchain community is not standing still in the face of the quantum threat, with the most obvious solution already being to switch to a new algorithm or develop quantum-resistant encryption methodology already underway. In fact, there is even an organization that purports to have developed the first quantum-resistant ledger, demonstrating that the community is responding proactively to the quantum possibility. No matter what economic category is being discussed, when a competitive threat emerges it spurs creativity and developments that improve the category as whole; quantum could be the force blockchain developers need to spur new developments and an improved user experience.

Forecasts of entire industries, including the blockchain sector, being swept away by a tsunami of quantum computing also ignores some of the most pertinent facets of any economic conversation. The most important resource or tool, no matter the era, is the innovative and creative thinking of the individuals that actually comprise an economy and society. Assuming that humans, who have created quantum computing, will not be able to make productive use of it and instead only use it to crack encryption, is an erroneous train of thought to follow. The most valuable resource in any economy are the people creating, thinking, and harnessing new tools to create new ideas.

Assuming that this will stop with quantum computing is short-sighted and sells short the power of human intellectual curiosity that drove the creation of this technology in the first place.

Technological innovation is a constant back and forth between rival platforms and options, and the blockchain space is not exempted from this reality; that is a good thing. Continued competition and development is the surest path to the best product or service.

Quantum computing, and the disruptive threat it poses to blockchain, may actually end up being the motivating factor the community needs to make the developments necessary for the technology to become mainstream. Lower costs, improved user experiences, and a better underlying product are results spurred forward by competitive forces, and that is what the blockchain community is facing right now.

Competition is a good thing, and that — at the end of the day — is what quantum supremacy actually represents.

Sign up here to be notified of new articles from Sean Stein Smith and AIER.

Sean Stein Smith is a Visiting Research Fellow at the American Institute for Economic Research, focusing on blockchain, cryptoassets, and the economic impact of these technologies. He is an Assistant Professor at the City University of New York (Lehman College), serves on the Advisory Board of Wall Street Blockchain Alliance, where he also chairs the Accounting Working Group, and chairs the Emerging Technology Interest Group of the New Jersey Society of CPAs. His research has been quoted in dozens of scholarly and practitioner publications, and he is a regular speaker at accounting and technology conferences. Follow him on Twitter.

This article was sourced from AIER.org

Image credit: Pixabay