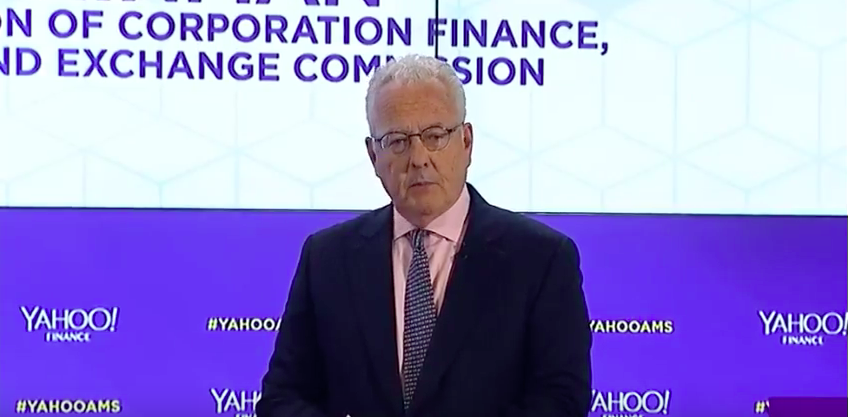

In an announcement at Yahoo Finance’s All Market Summit: Crypto in San Francisco, the U.S. Securities and Exchange Commission Director of Corporate Finance, William Hinman, said that the commission would not be classifying ether or Bitcoin as securities, Yahoo News reported.

The official told the audience that “We don’t see a lot of value in treating ether today as a security,” explaining that the fact that there is no central figure or group responsible for ethereum, and therefore “the assets may not represent an investment contract.”

In pre-written remarks, he said:

“Based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions.”

The commission’s policy is in line with what SEC Chair Jay Clayton has said recently about Bitcoin:

“Cryptocurrencies: These are replacements for sovereign currencies, replace the dollar, the euro, the yen with bitcoin,” Clayton said. “That type of currency is not a security.”

However, any currencies which represent an investment in a company affecting the value of the token are categorically securities, according to Clayton, and will be regulated just like any other security under SEC jurisdiction.

“A digital asset where I give you my money and you go off and start a venture, and in return for giving you my money you say you know what, I’m going to give you a return, or you can get a return on the secondary market by selling your token to somebody – that is a security, and we regulate that. We regulate the offering of that security, and we regulate the selling of that security.”

“If you have an ICO or a stock, and you want to sell it in a private placement, follow the private placement rules. If you want to do any IPO with a token, come see us. File financial statements, file disclosure, take the responsibility our laws require,” Clayton added.

Cryptocurrencies are not securities and the definition of “security” would not change to include Bitcoin. (Clayton said digital tokens were securities, but cryptocurrencies were not.) Hinman’s announcement marks the official position of the SEC: the name isn’t important, but the way in which it’s sold, promised, and behaves is the key deciding factor.

Hinman stated that the SEC will not be changing cryptocurrency and digital asset rules, but rather would be applying them. Previously, Bitcoin and Ether may have been offered as securities (like shares of a company), which would have required registration with the SEC, but a consensus has emerged that they behave and are treated like commodities, similar to gold and oil.

“Can a digital asset originally sold in a securities offering eventually be sold in something other than a security?” he asked. “How about cases when there’s no longer a company involved? I believe in those cases answer is a qualified yes.”

Hinman said “form is disregarded for substance,” in the SEC’s thinking. The economic realities, he said, are more important than how something is labeled.

If a cryptocurrency network is sufficiently decentralized and purchasers no longer have expectation of managerial stewardship from a third party, a coin is not a security, Hinman added.

Similarly, labeling an investment opportunity as a “coin” or a “token” does not make something not a security, Hinman added.

Officials at the Commodities and Futures Trading Commission (CFTC) had long urged the SEC to clarify its position on Ether, and the two agencies had been discussing how the currencies were first offered. The CFTC allowed Bitcoin futures to be traded last year on three exchanges.

Had the SEC deemed Ether or Bitcoin securities, cryptocurrency markets would have likely been sent into a selling frenzy, faced with uncertainty on how regulation would apply to exchanges, ownership, and markets. Although, it’s important to note that Hinman’s remarks don’t equate to whether the original sale of ETH was a security offering or not.

The SEC Director however further expressed as Clayton has that the SEC will not be making special rules either for tokens that represent the value of a project or for the majority of initial coin offerings (ICOs), going on to state that most ICOs are selling securities with the exception of a few.

The (SEC) Securities and Exchange Commission created a new senior advisory profession to oversee securities regulation of the crypto sphere in the U.S.

Last week, Valerie A. Szczepanik was appointed as the new SEC Senior Advisor for Digital Assets, as well as the Associate Director of the Division of Corporation Finance. Szczepanik will be in charge of “coordinating efforts across all SEC Divisions and Offices regarding the application of U.S. securities laws to emerging digital asset technologies and innovations, including Initial Coin Offerings (ICOs) and cryptocurrencies.”

The U.S. Securities and Exchange Commission held a meeting yesterday in Atlanta at Georgia State University where SEC commissioners spoke at the Investor Conference, Coinivore reported.

The mock town hall event featured break-out events where attendants met with members of the SEC for a more informal discussion on issues regarding regulation in the world of fintech, mutual funds, fraud prevention, and cryptocurrency.

Bitcoin is currently trading at [FIAT: $6,686.74] according to Coin Market Cap at the time of this report.

Want an edge in the crypto markets? Subscribe to our free newsletter. Follow Coinivore on Facebook, at Twitter and Steemit.