By Jeff Paul

If Bitcoin was working properly, there wouldn’t be support for forks. Forks are merely software updates. Yet because Bitcoin lacks a central decision maker, it’s challenging to get all parties to agree on updates.

The problem is that “working properly” means different things to different parties because Bitcoin is not just one thing. To some it’s primarily a store of value. To others it’s a currency and a payment network. Others focus on the computer protocol and equipment needed to maintain it. Bitcoin has users, developers, vendors, miners, wallets, exchanges and investors; each with their own self-interest and different opinion on scaling.

The failure to scale Bitcoin fast enough has caused bitter division and demand for better versions. After one successful fork (Bitcoin Cash), others are now happening. What are they? What makes them different? Who’s behind them? And which one has the best chance to succeed?

First Bitcoin Scaling Discussion

In 2012, cryptocurrency pioneer Erik Voorhees launched SatoshiDICE, an online dice game that settled bets directly on the Bitcoin blockchain. Odds were provably fair, payouts were nearly instant, nearly free, permanent and secured by the most powerful computing network on the planet (Bitcoin).

Within weeks, however, the site became responsible for more Bitcoin transactions than all other uses combined. Some accused SatoshiDICE of “spamming” the network, sparking one of the first discussions about scaling Bitcoin. It played out on the Bitcoin Talk forum in May 2012 in a post where Voorhees celebrated an “all-time transaction record.”

Voorhees writes:

“We just hit the all time Bitcoin transaction record…The transactions are actually real people placing real bets, so I guess they are legitimate for the transaction count, right?”

One user responds “Isn’t there a 1000-txn per block limit in place? Seems like satoshidice could cause that to be hit very quickly.”

The question left Voorhees and other “Legendary” and “Hero” members of the forum confused:

Voorhees responds by saying that such a low number of transactions per block is “Not suitable for a currency that will take over the world.”

I agree with Erik. It seems to me that a truly scalable Bitcoin should be able to handle thousands of sites like SatoshiDICE and many other applications in the micro-economy settling directly on the blockchain. Otherwise, what’s the point of scaling?

The 1000 transaction per block limit mentioned in the thread was actually incorrect. The limit was closer to 2260 transactions per 1MB block. Yet, obviously, it still proved to be woefully inadequate.

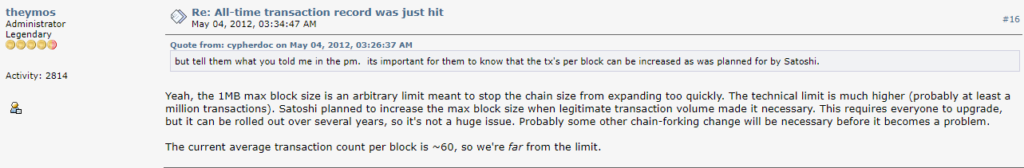

Interestingly, Theymos, the controversial admin of BitcoinTalk and /r/Bitcoin on Reddit, joined the thread to clarify Satoshi Nakamoto’s vision for scaling:

Theymos, who now opposes raising the block size, wrote:

Yeah, the 1MB max block size is an arbitrary limit meant to stop the chain size from expanding too quickly. The technical limit is much higher (probably at least a million transactions). Satoshi planned to increase the max block size when legitimate transaction volume made it necessary.

…

The current average transaction count per block is ~60, so we’re far from the limit.

Well, today we’re way above that limit. Bitcoin blocks are full. That’s why fees are high and transactions are slow. Transactions routinely cost more than $5 and can take 12 or more hours to confirm. In short, Bitcoin is far from the original promise of nearly “instant and free transactions.”

It’s no longer practical for people to use Bitcoin as money or retailers to use it as a payment network. Bitcoin Core’s scaling solution (a side chain called SegWit) has failed to relieve network congestion. As a result, Bitcoin is losing users and developers. Developers have less confidence in dedicating resources to develop on the Bitcoin network.

High fees and slow transactions killed many innovative Bitcoin projects. Gaming sites like SatoshiDICE that settled bets on-chain disappeared. Micropayment and tipping projects like ChangeTip disappeared. Coin mixers that enabled more anonymity in transactions disappeared. Vending machine developers also shelved their projects…until recently. More on that soon.

First, let’s examine how these recent forks came about and what problems they aim to solve.

Bitcoin Scaling & Forks Decoded

The upcoming SegWit2X fork planned for mid-November originated as a compromise agreement between a large cross-section of Bitcoin companies. In May 2017 they agreed to adopting SegWit and increasing the block size from 1MB to 2MB. This became known as the New York Agreement.

The original purpose of the proposal was to avoid a split in the community, as stated by developer Sergio Demian Lerner in a plea to bring people together in March:

The sole objective of this proposal is to re-unite the Bitcoin community and avoid a cryptocurrency split. Segwit2Mb does not aim to be best possible technical solution to solve Bitcoin technical limitations. However, this proposal does not imply a compromise to the future scalability or decentralization of Bitcoin, as a small increase in block size has been proven by several core and non-core developers not to affect Bitcoin value propositions.

However, instead of avoiding a split, the SegWit2X proposal itself represents the third contentious split of Bitcoin since the New York consensus.

This summer, Bitcoin Core devs launched Segregated Witness (SegWit) update on Bitcoin (BTC) and announced opposition to increasing blocks. They argued that raising the block size could make it more expensive to run a full Bitcoin node which in turn might result in fewer full nodes potentially making Bitcoin less decentralized. Yet, all they did was make Bitcoin less useful as money.

The SegWit update then triggered the Bitcoin Cash fork in August which rejected SegWit and raised the block size to 8MB. The circumstances that led to the Bitcoin Cash are explained well by Vee Tardrew of Bitstocks:

Up until 1 August 2017, the Bitcoin network had suffered from a stall in development as a result of an impasse of developers and the community regarding a viable scaling solution. You see, Bitcoin had gathered significant adoption and with it came a substantial increase in the number of transactions taking place. Because the Bitcoin blockchain had a 1MB block limit, miners were not able to keep up with the demand and processing time became slower and slower, at a maximum capacity of 7 transactions per second. (The current rate is reported to be between 2 – 3 transactions per second.) Subsequently, fees increased as users tried to incentivise quicker transaction times by paying higher fees for priority processing. With a vision of rivaling the capacity of the likes of the Visa or MasterCard networks, with low-cost transactions, Bitcoin desperately needed a solution. But being a decentralised technology meant that a majority consensus needed to be reached for any code changes to take place. And this is where the deadlock came about. With two different ‘camps’ presenting two different solutions, agreement was hard to come by.

One option called SegWit, proposed a solution that would enable off-chain scaling, while the second put forward an on-chain scaling solution which allowed for an 8MB block size. SegWit activation would see a change to the way that data within the block was structured, alleviating an issue called transactional malleability, and allowing for additional applications to run using the Bitcoin blockchain as a foundation. Essentially, this SegWit approach makes Bitcoin more akin to a multi-layered settlement system as opposed to a form of money. On the other hand, the bigger block supporters claimed SegWit was unnecessary and that Bitcoin would simply find itself in the same situation further down the line if it did not implement an increase in block size.

The Bitcoin Cash (BCH) fork garnered enough market and mining support to hold steady as the third highest market cap of all cryptocurrencies (above $10 billion at the time of this writing). Bitcoin Cash’s instant verifications and tiny fees re-enable some very exciting projects. More on this soon.

Bitcoin Core (BTC) supporters cried foul after the fork. They warned that bigger blocks incentivize more centralized mining. They claimed BCH miners were “stealing” hash power from the BTC network. Some even said they were “attacking” BTC merely for choosing to mine another blockchain.

Then extremists in the “miners are the problem” camp were behind the Bitcoin Gold (BTG) fork in late October as an attempt to decentralize mining. Bitcoin Gold is incompatible with the Bitcoin blockchain according to Coinbase. Bitcoin Gold changes the hashing algorithm from Sha256 which requires specialized ASIC mining equipment to Equihash (used by Zcash and others) which allows for GPU mining. Bitcoin Gold developers still have not released its code and they’re pre-mining 100,000 BTG, leaving many to believe it’s a bit scammy.

Meanwhile, the SegWit2X fork rapidly approaches and it’s unclear how it’s all going to play out. Segwit2X appears to still have support among some heavy hitters in the Bitcoin space like Coinbase, BitPay and some large miners.

If the SegWit2X upgrade to Bitcoin (BTC) happens without a hitch, the price will likely skyrocket. But it’s a temporary solution. It’s still a fragile compromise among warring parties. And because of the success of previous forks like Bitcoin Cash, it may already be too late to make peace. If that’s the case, the BTC chain may lose its dominance rapidly.

Summary of Bitcoin Forks (Chains)

Bitcoin Core (BTC) – Supply Cap: 21 million. 1 MB block size. Blocks are full (high fees, slow transactions). Scaling method: Side chains like SegWit and lightning networks aim to relieve congestion. Core devs claim increasing block sizes may reduce the number of full nodes making the network less distributed. BTC (SegWit1X) can currently handle up to 425,000 transactions per day.

Bitcoin Cash (BCH) – Supply Cap: 21 million. 8 MB block sizes. Mining difficulty adjustments ensure speed and lower fees. Scaling method: Bigger blocks. BCH can expand up to 32MB blocks without a fork. BCH aims to provide platform for instant micropayments and displace global payment systems like Visa. It can already handle up to 8,000,000 transactions per day.

Bitcoin Gold (BTG) – Supply Cap: 21 million. 1 MB block size. Changed from Sha256 algorithm to Equihash to enable GPU mining in attempt to increase miner distribution. No code released yet. Developers are said to be pre-mining 100,000 BTGs before release. Scaling method: side chains. BTG can handle up to 425,000 transactions per day.

Bitcoin S2X (November fork) – Fork maintains SegWit adoption while also increasing the block size to 2 MB as per the New York Agreement that was a compromise observed by several large Bitcoin companies. Bitcoin SegWit2X will be able to handle up to 800,000 transactions per day – twice that of BTC-S1X, but only 10% of Bitcoin Cash’s capacity.

Any new cryptocurrency faces the huge challenge of gaining user adoption. Forks of Bitcoin bypass that by piggybacking on Bitcoin’s network effect. Forks act like stock splits. Holders of Bitcoin get an equal number of the tokens on the new forked chains. This network gives them instant market value. Yet they still require support from miners, wallets and exchanges to be secure and useful.

If you have bitcoin in a wallet where you hold the private keys, you’ll be able to receive the SegWit2X units when it forks, assuming it doesn’t just become the upgraded Bitcoin. If you hold your bitcoin at Coinbase, they’ll automatically handle the split for you.

Coinbase originally wrote this about SegWit2X “Within 24 hours post fork. Coinbase customers will be able to buy and sell both Bitcoin and Bitcoin2x. When you visit Coinbase.com or open your Coinbase app, you will see your new Bitcoin2x balance (in Accounts).”

A few days later Coinbase clarified, “We are going to call the chain with the most accumulated difficulty Bitcoin.” Adding, “We will make a determination on this change, once we believe the forks are in a stable state. We may consider other factors such as market cap or community support to determine stability.”

Even the biggest companies in the space don’t know what the hell they’re going to do. This seems to leave open the option for Bitcoin Cash to potentially become recognized as the official or dominant bitcoin chain. It is already being called the “the real bitcoin” by Roger Ver and Bitcoin.com and other influential people in the space.

Why Bigger Blocks (Bitcoin Cash) Will Win

Personally, I’m betting Bitcoin Cash will be the winner when all the dust settles. It has a more cohesive vision, better leadership, unique tech, and it has the support of big miners, deep financial backing and influential media support. How many “altcoins” can claim the same resources?

This is not to say that Bitcoin SegWit2x upgrade won’t win the market temporarily. But the potential for Bitcoin to entirely replace corrupt government currencies and predatory commercial banks is the vision I signed up for. In order for it to achieve that status, it must be instant, cheap, secure, private, permissionless, and it must be able to handle a shit-ton of transactions per second.

Bitcoin Cash is focused on growing to that scale. Some applications require a commitment to microscopic fees and instant transactions for devs to justify spending time and money on projects where those attributes are crucial to its success.

Legacy Bitcoin Core (BTC) developers seem downright hostile to that vision. They are more focused on securing value for HODLers (speculators who don’t use bitcoin as currency). But BTC can’t be a one-trick pony that only provides a store of value. Nearly all crypto assets secure digital scarcity like BTC does. As Bitcoin (BTC) becomes less useful as money, it will likely become less valuable in the market.

As Roger Ver points out:

Simply being scarce isn’t enough to give something value. It must be USEFUL and SCARCE. Full blocks are destroying Bitcoin’s usefulness.

— Roger Ver (@rogerkver) October 27, 2017

I encourage you to read the responses beneath this tweet to get a sense of the sophomoric vitriol on the other side.

In addition to having the support of someone as influential as Roger Ver, Bitcoin Cash also has other very prominent supporters like Jihan Wu, co-founder of Chinese mining giant Bitmain, and Jiang Zhuoer, founder of the world’s third largest mining pool.

Jiang Zhuoer recently told CoinDesk “To be honest, I do not care about bitcoin now, bitcoin cash is bitcoin. I earn by mining bitcoin, [selling it] and buying bitcoin cash. We mine for the most profit and buy bitcoin cash.”

These heavyweights support Bitcoin Cash because it is more useful as money. It is bringing zombie Bitcoin projects back to life.

Return of SatoshiDICE

Remember the story of SatoshiDICE dying because the network got too slow and expensive? It’s back in business thanks to Bitcoin Cash.

Because Bitcoin Cash allows for instant settlements and tiny fees, it enables many other types of micropayment applications secured directly on the Bitcoin Cash blockchain.

Return of Micropayments

Ryan Charles was hired by Reddit to integrate Bitcoin into the “Front Page of the Internet.” When Reddit scrapped their blockchain plans, Ryan was still determined to monetize social media and news aggregation using Bitcoin micropayments. So he began working on a social blogging platform called Yours.org that included easy payment to content creators and a cost to comment to eliminate spam.

Ryan originally wrote Yours’ code for on-chain Bitcoin (BTC) micropayments. Yet network congestion made this microtipping model impossible. After a frustrating setback writing a bunch of code to be compatible with side payment channels, he decided to switch to Litecoin which relieved some issues, but only slightly. Then he tried Bitcoin Cash and everything worked!

Ryan Charles writes:

We watched the launch of Bitcoin Cash with great interest, because the commitment of the Bitcoin Cash community toon-chain scaling was music to our ears. Theoretically, with sufficient on-chain capacity, fees for on-chain transactions would be low enough to not need payment channels at all.

When it became clear that Bitcoin Cash was viable and could not die due to the EDA, we announced we were switching to Bitcoin Cash. We swallowed our pride and archived 10,000 lines of payment channel code and started using on-chain Bitcoin Cash transactions. This immediately improved our payment reliability to 100%, and relieved us of so much development burden that we have been able to move about 10 times faster iterating our product. We called the new product our beta and began adding features as quickly as possible, such as voting, paid comments, editing, a new UI, and a lot more.

The primary difference between Bitcoin Cash and Litecoin is that Bitcoin Cash has fees for on-chain transactions that are about 0.15 cents most of the time. That is 0.0015 USD. Litecoin has fees of about 5 cents. Although Litecoin’s fees are low by most payment system standards, they are not low enough to support native micropayments. Litecoin still needs payment channels for micropayments, which means the cost to our company is enormous to continue to develop and maintain the payment channel technology.

Furthermore, the Litecoin community has a philosophical overlap with Bitcoin and is not committed to on-chain scaling. The Bitcoin Cash community, by contrast, is fully committed to on-chain scaling and intends to increase the block size as needed in order to ensure that fees remain low. This is a critical difference. By switching to Bitcoin Cash, we know we can rely on low fee transactions indefinitely without the need for payment channels. But with Litecoin, it was possible we would end up in the same situation we are today with Bitcoin, which is with fees so high that even with payment channels they are cost prohibitive for micropayments.

The super small fees and near instant transactions of bitcoin cash also re-open opportunities to create solutions for retailers, vending machines, small remittances, microloans, coin mixers and much more. The original promise of Bitcoin.

Flippening of Most Secure Hashing Network

If the SegWit2X fork is contentious, it will likely split the mining power with Bitcoin SegWit1X. That means Bitcoin Cash could end up with the most hashing difficulty, and become the most profitable chain for miners to mine.

This theory is well presented in this Reddit thread which concludes “choosing to mine Segwit2X is a higher risk strategy than mining Bitcoin Cash, and that BCH is almost certain to be the dominant chain” and “believers in 1MB blocks are almost certainly going to lose their investment in Bitcoin.”

I highly recommend reading the whole thread, but the Redditor summarizes:

With the upcoming fork, miners (providers of hashrate) have four choices. They can:

- Dedicate their hash rate to the 1MB Segwit Bitcoin chain (Segwit1X)

- Dedicate their hash rate to the 2MB Segwit Bitcoin chain (Segwit2X)

- Dedicate their hash rate to Bitcoin Cash (BCH)

- Split their hash rate across two or three of the chains

At this point, you have to put yourself in a miner’s shoes, and ask yourself what you’d do. You’ve sunk millions into this, and could potentially make billions. Which choice do you make?

- If some miners mine Segwit1X, and some miners mine Segwit2X, both of these chains suffer a significant reduction in hashrate, and lose capacity.

- If miners split their hashrate across several chains, both Segwit1X and Segwit2X suffer a reduction in hashrate, and lose capacity.

- The only chain which can survive a significant reduction in hashrate is Bitcoin Cash.

For either Segwit1X or Segwit2X to survive, they require a majority of hashrate in order to ensure that the chain has enough capacity to meet demand. If it doesn’t have enough capacity, investors will (as they have in the past) invest in other cryptocurrencies instead.

Technical Analysis of Bitcoin Cash

A technical analyst on TradingView.com recently explained how Bitcoin Cash could take over as the dominant “bitcoin” chain.

Because Bitcoin Core is only able to retarget difficulty every 2016 blocks, regardless of how long those blocks take to be found. What this means is that if Bitcoin Core loses a lot of hashpower in late October or November to either S2X or Bitcoin Cash, that the Bitcoin Core chain may pile up beyond salvation with unconfirmed transactions and will be unable to extricate itself from the ensuing death spiral even if it miraculously received a difficulty re-target because of the 1MB block size.

Thus, it’s important for every single Bitcoin Core holder to hold a hedge for this potential event (by buying Bitcoin Cash), in my opinion.

I’m making the call now: Bitcoin Cash’s current breakout is 100% real. The bull flag, volume, and lack of hysterical Z-Cash 0.15% style pump are all major indicators. It is by no means finished.

Cash will revisit $700 in the very short term future, and will suddenly make itself very, very relevant in the discussion of which chain will wear the Crown in November.

This trader wrote this post a week ago when Bitcoin Cash (BCH) was $350. His price prediction was spot on. The price recently surpassed $650.

He predicts that “Greed and fever will set in when Bitcoin Cash breaks $1,000. Even Bitcoin Core has not seen the level of parabolic hysterical fever that is coming….And for one of the very rare times in history, everyone knows what Bitcoin Cash is worth if it becomes Bitcoin ($5,000+).”

Finally, here’s a recent video by popular cryptocurrency YouTuber CryptoBud detailing the undeniable strengths of Bitcoin Cash:

Conclusion

In short, I believe in the vision of Bitcoin Cash and the people who support it more than I do for Bitcoin Core (BTC). Ultimately, the winner will be determined by the market which is not always rational. Cryptocurrency is the poster child for irrational exuberance. It can take time to flesh out which technology works best for most applications and parties involved. If the SegWit2X fork goes smoothly and is recognized as “Bitcoin” by miners and exchanges, you won’t need to do anything but enjoy the ride. If it ends up being another contentious fork (which many predict), Bitcoin Cash may appear to be the most stable option. If that happens, the miner and market “flippening” may take place where BTC loses dominance to BCH.

Jeff Paul is the editor of Coinivore and Counter Markets newsletter where this article first appeared. Follow on Coinivore on Twitter and Steemit.