By J.P. Koning

Ever wonder why PayPal balances are always worth $1? PayPal uses a time-tested recipe for creating a stable representative of the dollar: it makes sure that each PayPal dollar is backed by sufficient assets.

But a new breed of financial engineers, so-called algorithmic stablecoin designers, want to do something that’s never been done before. They want to create a stable representative of the dollar, but without any assets to back it. That is, they want to fabricate stability… out of nothing.

Is this even possible? Or are these experiments destined to fail?

A PayPal dollar is stable because for each dollar it has issued, PayPal keeps another dollar in a bank account or invested in safe government debt. As long as PayPal’s assets retain their value, and customers can freely convert between PayPal dollars and bank dollars, then the value of PayPal dollars will never deviate from $1.

This is an old formula. A 19th-century issuer of ten-shilling banknotes kept at least ten shillings worth of interest-earning loans and coin reserves in its vaults. That, combined with its promise to redeem the notes on demand, ensured that its ten-shilling banknotes were always worth ten shillings.

Cutting edge financial technologists continue to rely on this old fashioned recipe. MakerDAO, a blockchain-based protocol that manages the Dai stablecoin, backs the $1.5 billion or so Dai stablecoins that are in circulation by holding around $4.5 billion worth of Ethereum, bitcoin, and other cryptoassets in reserve.

But is this stock of collateral and reserves even necessary? A crew of algorithmic stablecoin designers thinks not. They want to issue dollar-denominated stablecoins that are pegged at $1, but they also want to be “capital efficient.” That is, they want to be liberated from the obligation of holding huge amounts of collateral to stabilize their pegs.

How do algorithmic stablecoins work?

An algorithmic stablecoin system begins life by generating a number of digital tokens, or stablecoins, out of thin air. If the stablecoin trades above $1, then the system automatically creates new stablecoins until the price falls back to $1. That’s the easy part.

If the stablecoin falls below $1, things are a bit trickier. To restore the peg, an algorithmic stablecoin system must reduce the supply of stablecoins. Empty Set Dollar (ESD), the largest of the algorithmic stablecoin systems, does so by encouraging users to exchange their ESD stablecoins for coupons. These coupons lock up ESD stablecoins for a period of time. In theory, as more funds shift into coupons, enough ESD stablecoins will be removed from circulation that their price rises back up to $1.

To encourage users to buy coupons, the Empty Set Dollar system sets an enticing exchange rate between ESD stablecoins and coupons, say 1 ESD stablecoin to 1.1 coupons. So if you own 10 ESD stablecoins, and their price falls below the $1 peg, the system will let you convert your 10 ESD stablecoins into 11 coupons. When (or if) the price of ESD stablecoins rises back above $1, you’ll be able to reconvert your coupons into 11 ESD stablecoins. Voila, your 10 ESD stablecoins have become 11, for a 10% profit.

Got that? A coupon, in short, can be thought of as a promise to pay even more ESD stablecoins in the future, conditional on locking up one’s ESD stablecoins now, but only if and when the $1 peg has been restored.

The further that the price of ESD stablecoins falls below $1, the more enticing the system-set conversion rate into coupons gets. Put differently, the more that it fails, the more the algorithmic stablecoin system tries to harness forces to repair itself.

This all sounds good in theory, but what about in practice? Luckily for us, algorithmic stablecoins aren’t just ideas jotted down on paper. ESD debuted last September and is providing real data on how these things function. A second algorithmic stablecoin has joined it. Dynamic Set Dollar (DSD), a clone of ESD, hit the pavement running in late November.

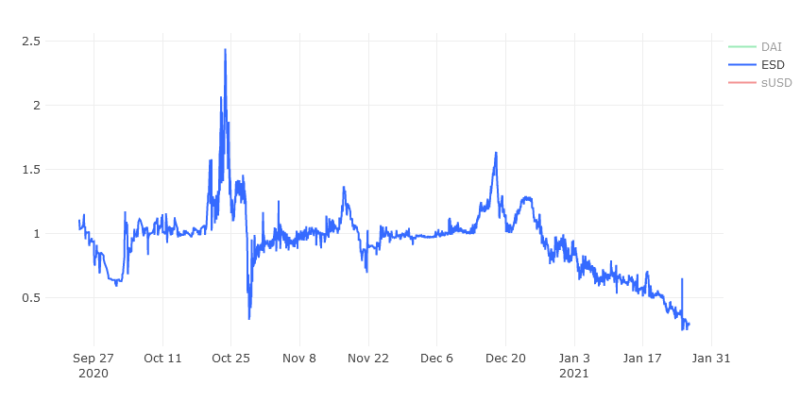

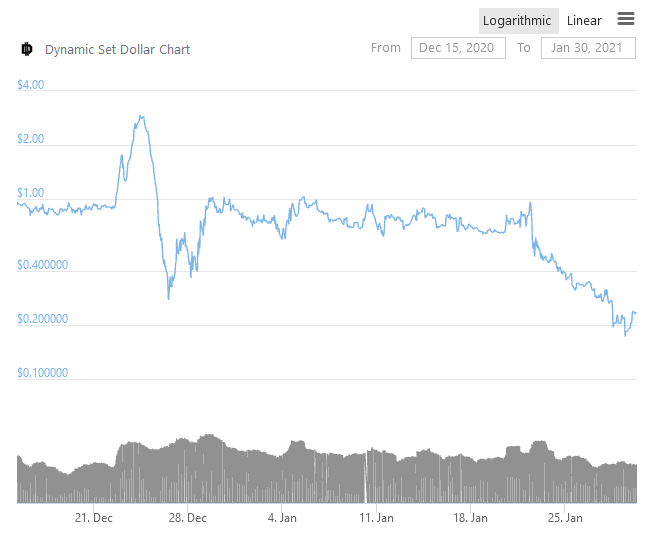

Both algorithmic stablecoins have proven to be popular. At their peaks in late December 2020, ESD and DSD had respectively issued $550 million and $300 million worth of stablecoins into circulation.

How close did their prices hew to $1? For the first few months, the pegging mechanisms seemed to work. When ESD or DSD rose above $1, new coins were created, driving their prices back down. And periods of sub-$1 prices were successfully fixed, too, with the aforementioned coupon freezing mechanism pushing them back up to $1.

However, since late December the price of ESD has gradually fallen to 23 cents. DSD stablecoins have fallen to 24 cents. There is little indication that either will ever return to $1. The value of ESD is presented in Figure 1. The value and volume of DSD is presented in Figure 2.

Figure 1. Empty Set Dollar (Sep 24, 2020 to Jan 26, 2021).

Figure 2. Dynamic Set Dollar price (Dec 10, 2020 to Jan 30, 2021, logarithmic scale).

Are Empty Set Dollar and Dynamic Set Dollar permanently broken?

It’s probably too early to tell. But I would suggest that algorithmic stablecoins are prone to permanent breakage. To understand why, let me propose a simple way to think about these systems. The success of an algorithmic stablecoin is reliant on a careful dance between two types of participants. Jack likes stability, and so he has a preference for stablecoins. Jill likes to speculate, and prefers high-return opportunities like coupons.

The relationship between the two is circular. Jack’s decision to hold ESD stablecoins is contingent on whether he trusts that Jill will buy coupons when the peg breaks. But Jill’s decision to buy coupons is contingent on whether she trusts Jack to use the ESD stablecoin system.

As long as the two participants stay positive, their mutual expectations can keep the system moored to $1. But if, for any reason, Jack and Jill’s self-referential beliefs in each other begin to deteriorate, the stablecoin price will irrevocably collapse. Jack won’t use stablecoins because he doesn’t think that Jill will support the system by buying coupons. Jill won’t support the system because she doesn’t think Jack will use the system’s stablecoins.

It might be possible for algorithmic stablecoin users’ self-referential beliefs in each other to keep the $1 peg running for a period of time. But this equilibrium is fragile. In any given time period, there is some chance the system will break down. Hence, the probability that the system will break down in some time period between now and x approaches 1 as x approaches infinity. In other words: the system is very likely to break down at some point, even if it is unlikely to break down today.

The stability of traditional dollar representatives like PayPal balances or MakerDao’s Dai stablecoins relies on a less fragile stabilization mechanism than the self-referential expectations of its users. PayPal and Dai’s stockpiles of assets, or collateral, are what secure them. If PayPal or MakerDAO users suffer from a sudden flight in confidence, the existence of an independent anchor of solid reserves should help defeat, or at least dampen, negative feedback loops.

Efforts to create stability without collateral are ambitious. The evidence that Empty Set Dollar and Dynamic Set Dollar have provided over the last few months suggests they are too ambitious. An algorithmic stablecoin only works so long as its users’ self-referential beliefs persist.

Source: AIER